.jpg) HARRISBURG, Pa. - This past week the Pennsylvania House and Senate sent two bills to the Governor for his signature that exempt high tunnels and hoop houses from real estate taxes, SB 638 and HB 1439. Both bills received unanimous approval in both houses.

HARRISBURG, Pa. - This past week the Pennsylvania House and Senate sent two bills to the Governor for his signature that exempt high tunnels and hoop houses from real estate taxes, SB 638 and HB 1439. Both bills received unanimous approval in both houses.

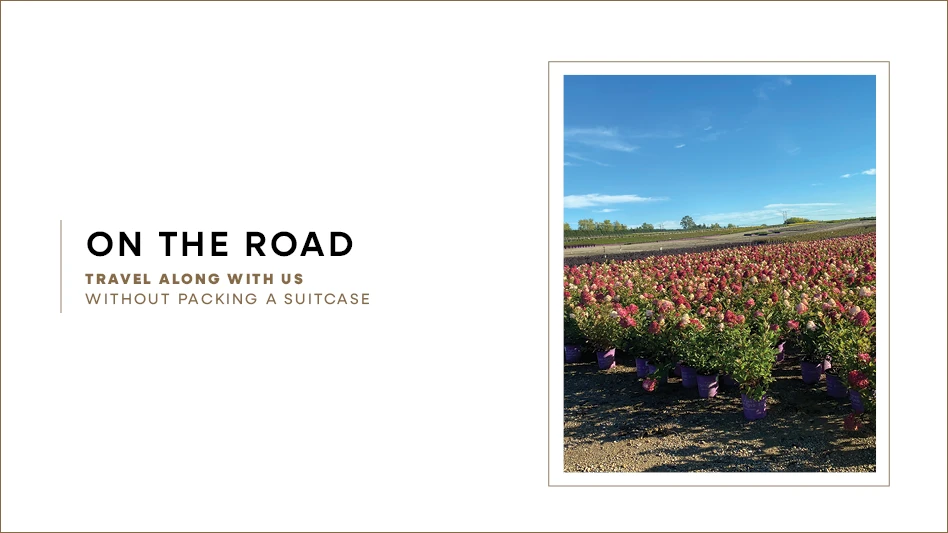

Over the past several years, two counties in Pennsylvania (Blair and Erie) had begun to levy real estate taxes on high tunnels. These plastic covered structures are used to extend the growing season and protect plants from snow and winter winds.

Developed by Penn State in the late 1990's, high tunnels were quickly adopted by many sectors of agriculture to extend the growing season, shelter animals and for a variety of other agricultural uses. Their use spread quickly beyond Pennsylvania to the entire country.

"We want to thank the chairman of the Senate Agriculture and Rural Affairs Committee, Elder Vogel (R - Beaver) and chairman of the House Agriculture and Rural Affairs Committee John Maher (R - Allegheny)," said Jim Mackenzie, board chair of the Pennsylvania Landscape and Nursery Association. "Senator Vogel, Representative Maher and their staffs worked to draft legislation and shepherd it through the legislative process in a very busy year."

"We are pleased that the General Assembly moved so quickly on this," said chairman of PLNA's Government Affairs Committee Dan Eichenlaub. "Once they became aware of the problem, legislation was drafted, introduced and passed within nine months."

High tunnels have allowed nurseries, landscape contractors and garden centers to extend the growing season into the spring and fall, and to protect their plants from snow damage and temperature extremes during the winter. If high tunnels were to be taxed, it would have removed the economic benefits of these inexpensive structures.

"One of the keys to the success of this legislative effort was the backing of the Pennsylvania State Council of Farm Organizations (PSCFO)," said Gregg Robertson, government relations consultant to PLNA and a board member of PSCFO. "PSCFO provides a forum in which all segments of Pennsylvania agriculture could work together on this common issue."

"We were able to quickly mobilize the Pennsylvania Farm Bureau, the Pennsylvania State Grange, the Pennsylvania Vegetable Growers Association and the other sixty members of PSCFO," said Robertson. "I think legislators appreciated that agriculture was speaking with one voice."

PLNA estimates that this legislation will save the landscape and nursery industry and other segments of Pennsylvania agriculture millions of dollars in increased real estate taxes in the coming years, allowing the continued use of the high tunnel technology.

Nursery Management wrote about the high tunnel tax battle in its March 2013 issue.

High tunnel photo courtesy of Growers Supply

Latest from Nursery Management

- Jackson & Perkins expands into Canadian market

- Green & Growin’ 26 brings together North Carolina’s green industry for education, connection and growth

- Marion Ag Service announces return of Doug Grott as chief operating officer

- The Garden Conservancy hosting Open Days 2026

- Registration open for 2026 Perennial Plant Association National Symposium

- Artificial intelligence applications and challenges

- Fred C. Gloeckner Foundation Research Fund calls for 2026 research proposals

- Harrell’s expands horticulture team with addition of Chad Keel