SBA-backed loans for things like new construction carry lower interest rates and lower fees compared with its commercial counterparts. Earlier this year the White House outlined a $15 billion, multi-pronged plan to help ease the credit crunch affecting so many nurseries. One program earmarks extra funding for loans and technical assistance by the U.S. Small Business Administration’s (SBA) “microloan” lenders.

SBA-backed loans for things like new construction carry lower interest rates and lower fees compared with its commercial counterparts. Earlier this year the White House outlined a $15 billion, multi-pronged plan to help ease the credit crunch affecting so many nurseries. One program earmarks extra funding for loans and technical assistance by the U.S. Small Business Administration’s (SBA) “microloan” lenders.

In addition to extra funding for microloans, new ARC Stabilization Loans offer 100 percent guaranteed deferred payment of loans up to $35,000 to help viable small businesses facing immediate economic hardship.

The plan will also reduce small-business lending fees and increase the amount the SBA will guarantee on some small business loans.

The recovery program

The U.S. Treasury Department will boost bank liquidity by purchasing small business loans in the secondary markets. The $15 billion from the U.S. Treasury will primarily be used to buy loans and free up lending by community banks, credit unions and other small-business lenders. With these financial institutions accounting for 40 percent of all SBA-backed lending, the SBA’s announcement provides assurances to secondary markets the government stands ready to purchase 7(a) and 504 first-lien securities.

Since banks depend on the secondary markets for liquidity, a local community bank may now be more willing to lend to a nursery because it will have the confidence the U.S. Treasury will be a ready buyer of the loan in the secondary markets.

The SBA has raised guarantee levels on some of its loans and temporarily eliminated certain loan fees. Microloan intermediaries are already providing loans of up to $35,000 to start-up, newly established and growing small businesses.

Besides extra funding for microloans, new ARC Stabilization Loans offer 100 percent guaranteed deferred payment of loans up to $35,000. Expansion of the SBA’s Surety Bond Program raises the maximum amount for contracts that qualify for SBA surety bonds to $5 million-$10 million, for certain contracts.

Come and get it

The SBA does not actually make loans to nurseries; it is primarily a guarantor of loans made by private banks and other institutions. SBA-backed loans carry lower interest rates and lower fees compared with its commercial counterparts, making them more affordable for entrepreneurs and small-business owners.

An SBA guarantee gives nursery and other business owners access to the same kinds of reasonably priced, long-term financing available to large businesses by virtue of their size and economic clout. Borrowers apply for loans directly with a lending institution, such as banks, credit unions or small business lending companies.

Only lenders approved to participate in SBA lending programs can help with SBA-guaranteed loans. It is the private lender who determines whether a borrower’s application is acceptable. If it is, the lender forwards the application and its credit analysis to the SBA.

The 7(a) program

The SBA’s 7(a) program is the agency’s primary business loan program. Designed to help small businesses obtain financing when they might not otherwise be eligible through normal lending channels, the 7(a) program is the most flexible. The maximum loan amount for a 7(a) loan is $2 million.

Financing under this program can be guaranteed for a variety of general business purposes such as working capital, machinery and equipment, furniture and fixtures, land and buildings (including purchase, renovation and new construction), leasehold improvements and even debt refinancing. Working through commercial lending institutions, loans are up to 10 years for working capital and up to 25 years for fixed asset funding.

The temporary elimination of fees for 7(a) loans can mean substantial savings. Typically, those fees have ranged from 2-3.75 percent. On a $300,000 loan with a 75 percent guarantee, the guarantee would normally be 3 percent. With the temporary elimination of fees, the nursery business borrower would save $6,750 ($300,000 x 75 percent x 3 percent). With the new 90 percent guaranty, savings would be $8,100 ($300,000 x 90 percent x 3percent).

504 loans

Designed as a long-term financing tool for economic development within a community, the SBA’s 504 program helps nurseries and other businesses requiring “brick and mortar” financing. The 504 program provides long-term, fixed-rate financing to small businesses to acquire real estate, machinery and equipment for expansion or modernization. The 504 program can’t be used for working capital or inventory, consolidating or repaying debt or refinancing. Eligible nurseries must have a tangible net worth less than $7.5 million and an average net income less than $2.5 million after taxes for the preceding two years.

For 504 loans, the loan structures and amounts vary since lenders and borrowers each determine how much equity they are putting into the loan. However, for the SBA portion of the loan, the maximum amount is either $2 million or $4 million depending on the purpose of the loan. For most purposes, the SBA’s maximum guarantee for any borrower remains at $1.5 million, or 75 percent of a $2 million loan. The 1.5 percent application fee for a Section 504 loan has been eliminated.

Central to the 504 loan program is an entity known as a Certified Development Co., which works with the SBA and private-sector lenders to provide small-business financing.

The 7(m) program

The SBA’s microloan program provides short-term loans of up to $35,000 for working capital or purchases of inventory, supplies, furniture, fixtures and equipment. The SBA makes funds available to nonprofit community-based lenders (intermediaries) which make loans to eligible borrowers up to a maximum of $35,000. The average loan amount is around $13,000. Unfortunately, the proceeds from microloans, cannot be used to pay existing debts or to purchase real estate.

Take the next step

A nursery business in need of working capital, to make payroll or to buy inventory can immediately apply to a local SBA participating lender. Once the SBA receives a complete application package from the lender, they typically respond to the lender within a few business days.

Today, thanks to the newly-announced program, a nursery will immediately benefit from a 90 percent loan guarantee, see reduced fees for 7(a) loans and notice that fees have been eliminated for many SBA guaranteed loans. Microloan intermediaries around the country are already providing loans of up to $35,000 to start-up, newly established and growing businesses.

While many nurseries and growing businesses find themselves caught in the middle of the credit crunch and economic downturn, few have been turning to the country’s so-called “lender of last resort,” the U.S. Small Business Administration.

For more: U.S. Small Business Administration, www.sba.gov/services/index.html.

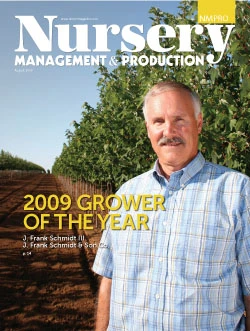

Explore the August 2009 Issue

Check out more from this issue and find your next story to read.

Latest from Nursery Management

- Hoffmann Family of Companies acquires Smith Gardens, Pacific Plug & Liner

- The funnel to freedom

- Applications now open for American Floral Endowment graduate scholarships

- The social sales engine

- New SustainaGuides on lighting and water conservation from Sustainabloom available

- Get to know Brian Kemble

- Meet the All-America Selections AAS winners for 2026

- Marshall Dirks announces retirement after 27 years with Proven Winners brand